Use these links to rapidly review the documentTABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

Preliminary Proxy Statement | ||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

SALLY BEAUTY HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

No fee required. | ||||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1)and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

3001 Colorado Boulevard, Denton, Texas 76210

Letter from our President and Chief Executive Officer

To our stockholders,

You are cordially invited to attend the annual meeting of stockholders of Sally Beauty Holdings, Inc., which will take place at the Sally Support Center,Beauty Headquarters, 3001 Colorado Boulevard, Denton, Texas 76210 on Thursday, January 26, 2017,30, 2020, at 9:00 a.m., local time. Details of the business to be conducted at the annual meeting are given in the Official Notice of the Meeting, Proxy Statement, and form of proxy enclosed with this letter.

Even if you intend to join us in person, we encourage you to vote in advance so that we will know that we have a quorum of stockholders for the meeting. When you vote in advance, please indicate your intention to personally attend the annual meeting. Please see the Question and Answer section on Page 4page 67 of the enclosed Proxy Statement for instructions on how to obtain an admission ticket if you plan to personally attend the annual meeting.

Whether or not you are able to personally attend the annual meeting, it is important that your shares be represented and voted. Your prompt vote over the Internet, by telephone via toll-free number or by written proxy will save us the expense and extra work of additional proxy solicitation. Voting by any of these methods at your earliest convenience will ensure your representation at the annual meeting if you choose not to attend in person. If you decide to attend the annual meeting, you will be able to vote in person, even if you have personally submitted your proxy. Please review the instructions on the proxy card or the information forwarded by your bank, broker, or other holder of record concerning each of these voting options.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of Sally Beauty Holdings, Inc.

| ||

| ||

Christian A. Brickman Director, President and Chief Executive Officer | ||

December 18, 2019

Table of ContentsSALLY BEAUTY

Sally Beauty Holdings, Inc.

HOLDINGS, INC.

3001 Colorado Boulevard, Denton, Texas 76210

Official Notice of Annual Meeting of Stockholders

To our stockholders:

The annual meeting of stockholders of Sally Beauty Holdings, Inc. (the "Corporation"“Corporation”) will take place at the Sally Support Center,Beauty Headquarters, 3001 Colorado Boulevard, Denton, Texas 76210 on Thursday, January 26, 2017,30, 2020, at 9:00 a.m., local time, for the purpose of considering and acting upon the following:

| (1) | The election of the twelve directors named in the accompanying Proxy Statement for aone-year term; |

| (2) | To approve an advisory(non-binding) resolution regarding the compensation of the Corporation’s named executive officers, including the Corporation’s compensation practices and principles and their implementation, as disclosed in the accompanying Proxy Statement; |

| (3) | The ratification of the selection of KPMG LLP as our independent registered public accounting firm for our 2020 fiscal year; and |

| (4) | To transact such other business as may properly come before the annual meeting or any adjournment thereof. |

Only stockholders of record at the close of business on December 1, 20162, 2019 will be entitled to vote at the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders

to be held on January 26, 2017:

30, 2020:

The Proxy Statement and the 20162019 Annual Report to stockholders are available at:

www.edocumentview.com/sbh

| By Order of the Board of Directors, | ||

| ||

John Henrich Corporate Secretary |

December 9, 2016

Table of Contents18, 2019

If you plan to attend the annual meeting you must have an admission ticket or other proof of share ownership as of the record date. Please see the Question and Answer section on Page 67 of this Proxy Statement for instructions on how to attend the annual meeting. Please note that the doors to the annual meeting will open at 8:00 a.m. and will close promptly at 9:00 a.m.

Whether you expect to personally attend the meeting, we urge you to vote your shares at your earliest convenience to ensure the presence of a quorum at the meeting. Promptly voting your shares via the Internet, by telephone via toll-free number or by signing, dating, and returning the enclosed proxy card will save us the expense and extra work of additional solicitation. The Internet voting and telephone voting facilities for stockholders of record will be available until 1:00 a.m., local time, on January 30, 2020. If your shares are held in street name by a bank, broker or other similar holder of record, your bank, broker or other similar holder of record is not permitted to vote on your behalf on Proposal 1 (election of directors) or Proposal 2 (approval of an advisory resolution regarding the compensation of the Corporation’s named executive officers, including the Corporation’s compensation practices and principles and their implementation) unless you provide specific instructions by completing and returning a voting instruction form or following the voting instructions provided to you by your bank, broker or other similar holder of record. Enclosed is an addressed, postage-paid envelope for those voting by mail in the United States. Because your proxy is revocable at your option, submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so. Please refer to the voting instructions included on your proxy card or the voting instructions forwarded by your bank, broker, or other similar holder of record if you hold your shares in street name.

TABLE OF CONTENTS 4 2019 PROXY STATEMENT SUMMARY

10 PROPOSAL 1 - ELECTION OF DIRECTORS 15 BOARD NOMINEE QUALIFICATIONS AND EXPERIENCE 16 CORPORATE GOVERNANCE, THE BOARD AND ITS COMMITTEES 16 Board Purpose and Structure 16 Corporate Governance Philosophy 17 Board Diversity 18 Corporate Responsibility and ESG 20 Director Independence 20 Nomination of Directors 20 Stockholder Recommendations or Nominations for Director Candidates 21 Director Qualifications 21 Annual Election of Directors 21 Mandatory Retirement Age of Directors 21 Directors Who Change Their Present Job Responsibilities 22 Board Self Evaluations 22 Board Meetings and Attendance 22 Board Leadership Structure 22 Communications with the Board 23 Board’s Role in the Risk Management Process 23 Committees of the Board of Directors 25 Compensation Committee Interlocks and Insider Participation 25 Compensation Risk Assessment 26 Related Party Transactions 2 SALLYBEAUTY HOLDINGS, INC. 2019 Proxy Statement

TABLE OF CONTENTS 27 Directors’ Compensation and Benefits 28 Narrative Discussion of Director Compensation Table 29 Director Indemnification Agreements 29 No Material Proceedings 30 BENEFICIAL OWNERSHIP OF THE COMPANY’S STOCK 31 Securities Owned by Directors and Executive Officers 32 Persons Owning More than Five-percent 33 PROPOSAL 2 - ADVISORY VOTE ON EXECUTIVE COMPENSATION 34 EXECUTIVE OFFICERS 36 EXECUTIVE COMPENSATION 36 Compensation Discussion and Analysis 54 Compensation Committee Report 55 Compensation Tables 62 CEO PAY RATIO 63 PROPOSAL 3 - RATIFICATION OF SELECTION OF AUDITORS 64 Report of the Audit Committee 66 DEADLINES AND PROCEDURES FOR NOMINATIONS AND STOCKHOLDER PROPOSALS 67 QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING 70 OTHER MATTERS A-1 APPENDIX 1 NON-GAAP FINANCIAL NUMBERS RECONCILIATION www.sallybeautyholdings.com 3

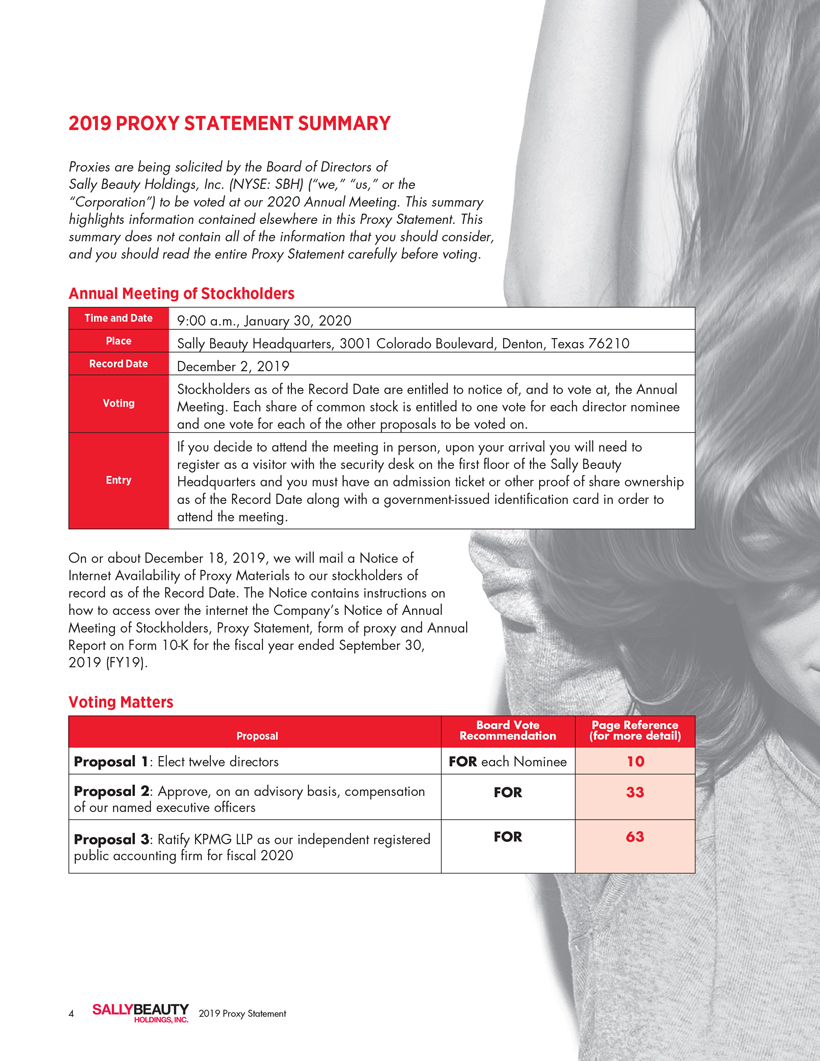

2019 PROXY STATEMENT SUMMARY Proxies are being solicited by the Board of Directors of Sally Beauty Holdings, Inc. (NYSE: SBH) (“we,” “us,” or the “Corporation”) to be voted at our 2020 Annual Meeting. This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Annual Meeting of Stockholders

| ||

| ||

| ||

| ||

| Time and Date 9:00 a.m., January 30, 2020 Place Sally Beauty Headquarters, 3001 Colorado Boulevard, Denton, Texas 76210 Record Date December 2, 2019 Voting Stockholders as of the Record Date are entitled to notice of, and to vote at, the Annual Meeting. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. Entry If you decide to attend the meeting in person, upon your arrival you will need to register as a visitor with the security desk on the first floor of the Sally Beauty Headquarters and you must have an admission ticket or other proof of share ownership as of the Record Date along with a government-issued identification card in order to attend the meeting. On or about December 18, 2019, we will mail a Notice of Internet Availability of Proxy Materials to our stockholders of record as of the Record Date. The Notice contains instructions on how to access over the internet the Company’s Notice of Annual Meeting of Stockholders, Proxy Statement, form of proxy and Annual Report on Form 10-K for the fiscal year ended September 30, 2019 (FY19). Voting Matters Proposal Board Vote Recommendation Page Reference (for more detail) Proposal 1: Elect twelve directors FOR each Nominee 10 Proposal 2: Approve, on | |

Meeting Agenda

Voting Matters2020 FOR 63 4 SALLYBEAUTY HOLDINGS, INC. 2019 Proxy Statement

i

Proposal 1 — Election of Directors (see page 7)

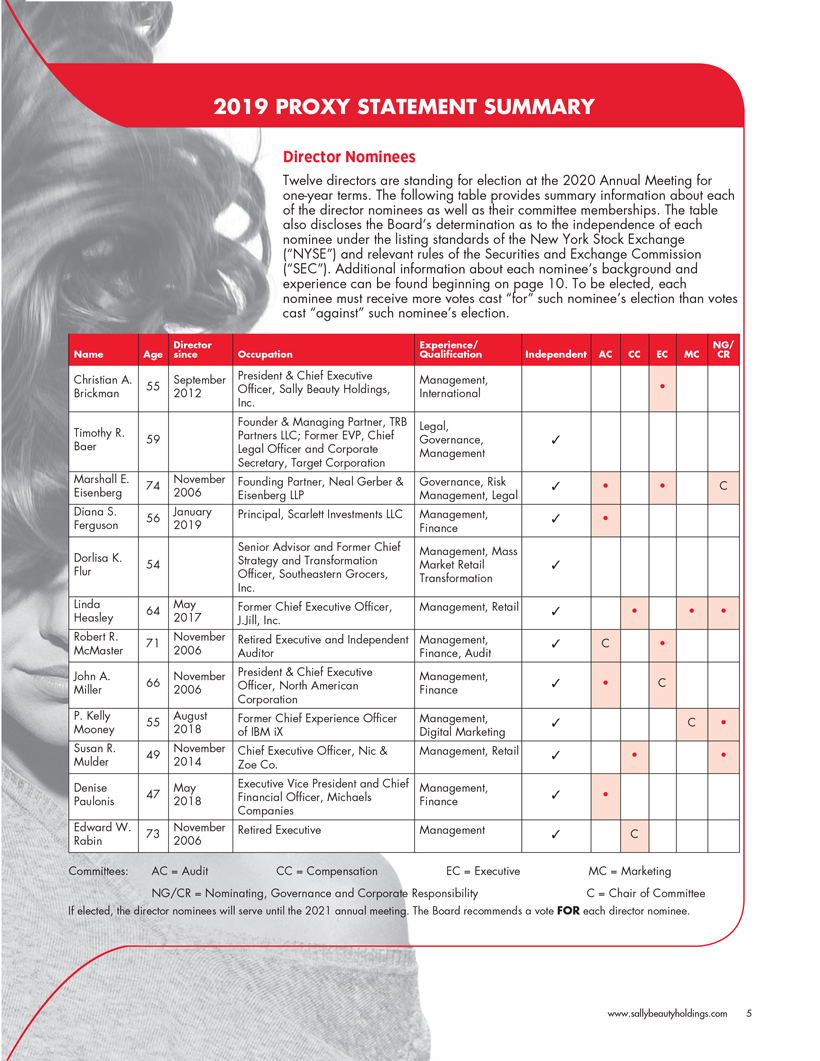

2019 PROXY STATEMENT SUMMARY Director Nominees Twelve directors are standing for election at the 2020 Annual Meeting for one-year terms. The following table provides summary information about each director nominee. The nominees receiving a plurality of the director nominees as well as their committee memberships. The table also discloses the Board’s determination as to the independence of each nominee under the listing standards of the New York Stock Exchange (“NYSE”) and relevant rules of the Securities and Exchange Commission (“SEC”). Additional information about each nominee’s background and experience can be found beginning on page 10. To be elected, each nominee must receive more votes cast at the meeting will be elected as directors.

“for” such nominee’s election than votes cast “against” such nominee’s election. Name Age Director since Occupation Experience/ Qualification Independent AC CC EC MC NG/ CR Christian A. Brickman 55 September 2012 President & Chief Executive Officer, Sally Beauty Holdings, Inc. Management, International • Timothy R. Baer 59 Founder & Managing Partner, TRB Partners LLC; Former EVP, Chief Legal Officer and Corporate Secretary, Target Corporation Legal, Governance, Management ✓ Marshall E. Eisenberg 74 November 2006 Founding Partner, Neal Gerber & Eisenberg LLP Governance, Risk Management, Legal ✓ • • C Diana S. Ferguson 56 January 2019 Principal, Scarlett Investments LLC Management, Finance ✓ • Dorlisa K. Flur 54 Senior Advisor and Former Chief Strategy and Transformation Officer, Southeastern Grocers, Inc. Management, Mass Market Retail Transformation ✓ Linda Heasley 64 May 2017 Former Chief Executive Officer, J.Jill, Inc. Management, Retail ✓ • • • Robert R. McMaster 71 November 2006 Retired Executive and Independent Auditor Management, Finance, Audit ✓ C • John A. Miller 66 November 2006 President & Chief Executive Officer, North American Corporation Management, Finance ✓ • C P. Kelly Mooney 55 August 2018 Former Chief Experience Officer of IBM iX Management, Digital Marketing ✓ C • Susan R. Mulder 49 November 2014 Chief Executive Officer, Nic & Zoe Co. Management, Retail ✓ • • Denise Paulonis 47 May 2018 Executive Vice President and Chief Financial Officer, Michaels Companies Management, Finance ✓ • Edward W. Rabin 73 November 2006 Retired Executive Management ✓ C Committees: AC = Audit Committee

CC = Compensation Committee

EC = Executive CommitteeNGMC = Marketing NG/CR = Nominating, Governance and Corporate Governance Committee

Responsibility C = Chair of Committee

If elected, the director nominees will serve until the 20182021 annual meeting. The Board recommends a voteFOR each director nominee. www.sallybeautyholdings.com 5

ii

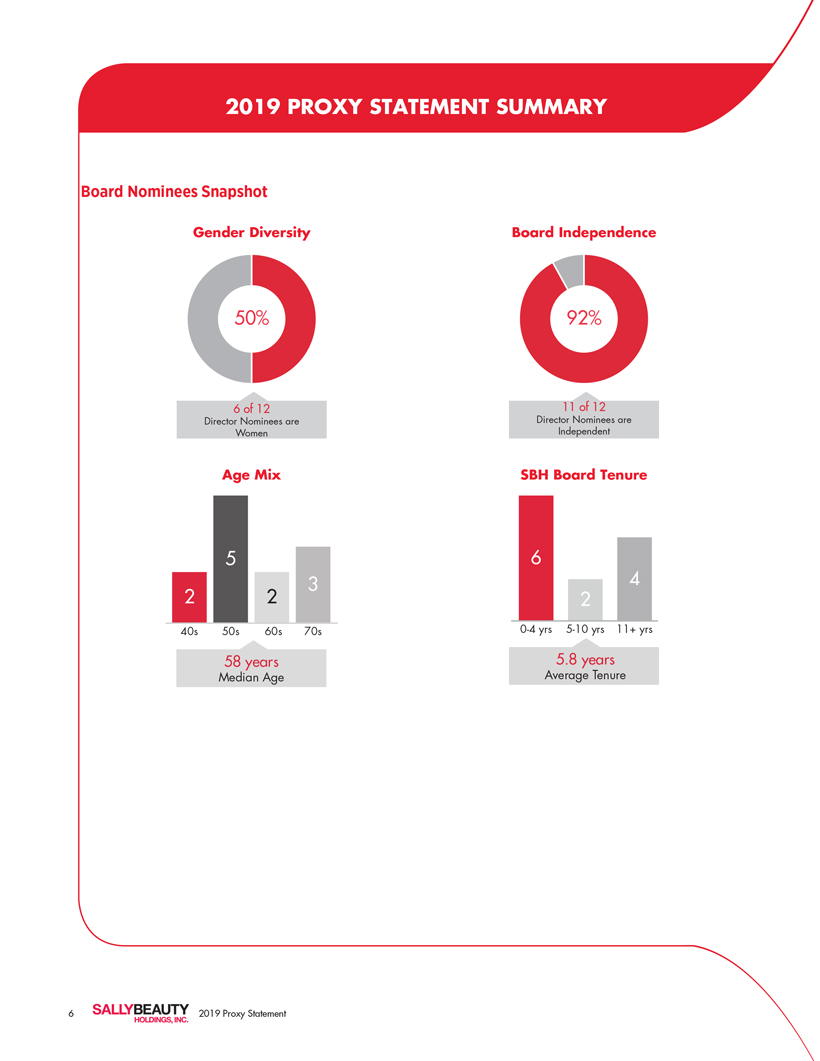

Table2019 PROXY STATEMENT SUMMARY Board Nominees Snapshot Gender Diversity Board Independence 50% 6 of Contents12 Director Nominees are Women 92% 11 of 12 Director Nominees are Independent Age Mix SBH Board Tenure 2 5 2 3 40s 50s 60s 70s 58 years Median Age 6 2 4 0-4 yrs 5-10 yrs 11+ yrs 5.8 years Average Tenure 6 SALLYBEAUTY HOLDINGS, INC. 2019 Proxy Statement

Proposal 2 — Approval

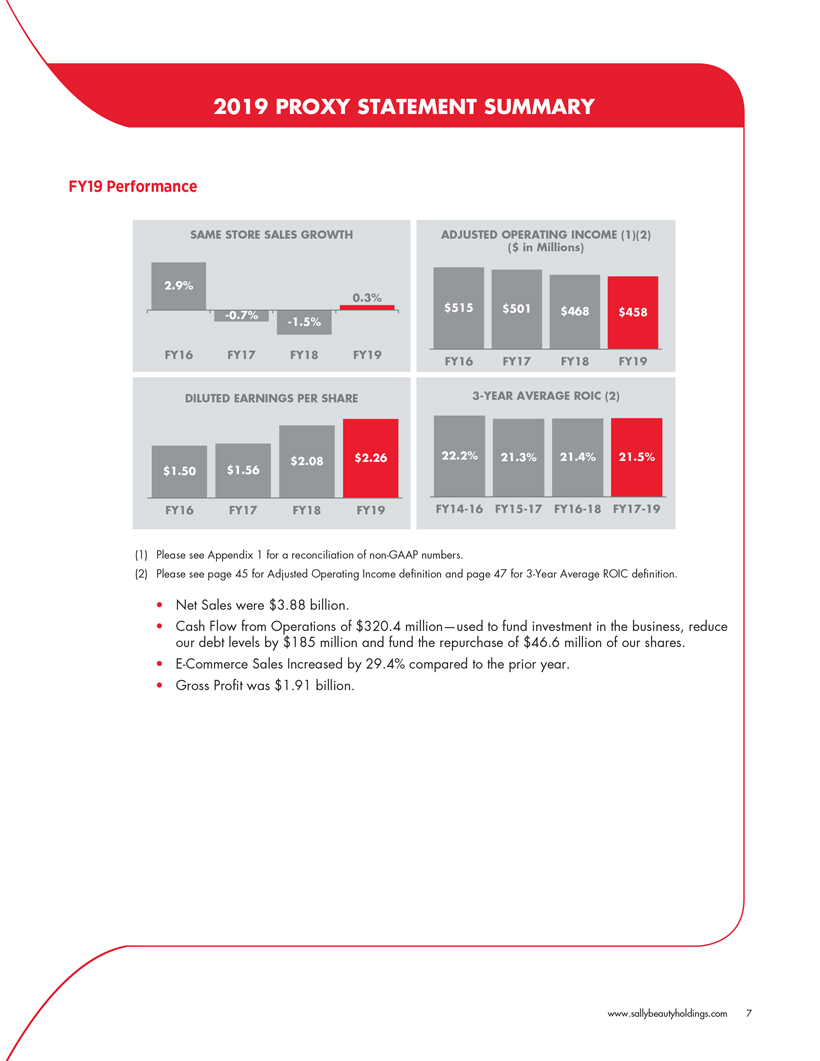

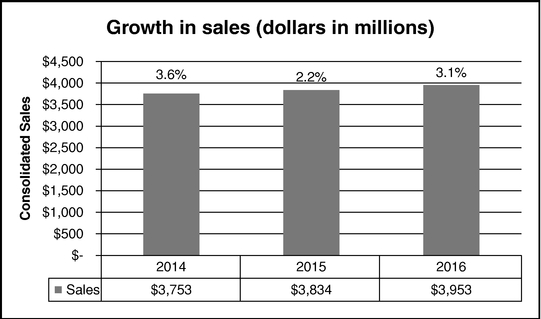

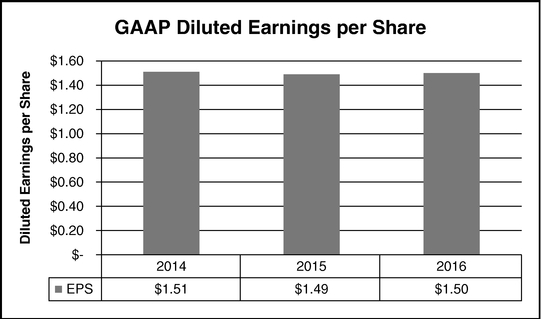

2019 PROXY STATEMENT SUMMARY FY19 Performance SAME STORE SALES GROWTH 2.9% -0.7% -1.5% 0.3% FY16 FY17 FY18 FY19 DILUTED EARNINGS PER SHARE $1.56 $2.08 $1.50 $2.26 ADJUSTED OPERATING INCOME (1)(2) ($ in Millions) $515 $501 $468 $458 FY16 FY17 FY18 FY19 3-YEAR AVERAGE ROIC (2) 22.2% 21.3% 21.4% 21.5% FY16 FY17 FY18 FY19 FY14-16 FY15-17 FY16-18 FY17-19 (1) Please see Appendix 1 for a reconciliation of Non-Binding Resolution Regarding Executive Officer Compensation(non-GAAP numbers. (2) Please see page 66)45 for Adjusted Operating Income definition and page 47 for 3-Year Average ROIC definition. Net Sales were $3.88 billion. Cash Flow from Operations of $320.4 million—used to fund investment in the business, reduce our debt levels by $185 million and fund the repurchase of $46.6 million of our shares. E-Commerce Sales Increased by 29.4% compared to the prior year. Gross Profit was $1.91 billion. www.sallybeautyholdings.com 7

We are asking stockholders2019 PROXY STATEMENT SUMMARY FY19 Strategic Objectives and Accomplishments Refocusing our efforts around our differentiated core of hair color and hair care Continued to approvebuild our innovation pipeline with new exciting brands. SBS: Added new brands such as vivid color lines (Good Dye Young and Arctic Fox). BSG: Added the prestigious color and care brand, Pravana, and Swedish vegan brand, Maria Nila. Launched Box Color across Sally Beauty network. Invested in marketing focused on an advisory (non-binding) basisbuilding awareness and education of these brands. Improving retail fundamentals with targeted investments in people, processes, technology and our stores Launched new Sally Beauty Rewards Loyalty Program, with over 15.9 million active members at the compensationend of FY19. Installed newstate-of-the-art POS system in over 1,400 Sally Beauty and CosmoProf stores as of the Corporation's named executive officers, includingend of FY19. Launched phase one of JDA, our new merchandising and supply chain platform. Optimized our supply chain footprint and transportation network to enhance speed and efficiency. Tested new store concepts for both Sally Beauty and BSG. Advancing our digital commerce capabilities Launched redesigned mobile-first Sally Beauty website. Launched new Sally Beauty app which allows consumers to access their Sally Beauty Rewards points and shop directly from the Corporation's compensationapp. Enhanced CosmoProf app to remove friction from the buying experience for our pro customers. Continuing to drive costs out of the business and operate efficiently In FY19 we found efficiencies and savings in how we operate the business through negotiations with service providers, more streamlined operations and better sourcing. 8 SALLYBEAUTY HOLDINGS, INC. 2019 Proxy Statement

2019 PROXY STATEMENT SUMMARY FY19 Corporate Governance Highlights Board adopted a revised charter of newly-renamed “Nominating, Governance and Corporate Responsibility” (NGCR) Committee. NGCR Committee given authority to oversee corporate responsibility and ESG-related matters. Board initiated sustainability materiality assessment of the Company. Company’s ESG-related efforts are focused on three main areas where we can have a material, meaningful impact: 1) Energy / Environment—we made progress towards reducing our environmental impact by reducing energy usage and increasing energy efficiency. We initiated our SBH Going Green Program, which we hope will eliminate plastic bags in our North American stores, and reduce waste and increase recycling capabilities at our Sally Beauty Headquarters. 2) Product Development and Sourcing—we continue to make progress toward our long-term sustainability goals by using best practices in product development and principlessourcing. 3) Diversity and Inclusion – we continue efforts to show that diversity and inclusion are at the heart of our company: at the Board level, throughout our global workforce and in our shared commitment to serving a diverse customer base and their implementation, as disclosed in this Proxy Statement. The Board believescommunities. FY19 Stockholder Outreach During FY19 we engaged with investors and sell-side analysts by hosting numerous meetings and investor calls, and attending equity conferences and non-deal roadshows. We believe that its current compensation program uses a balanced mix of base salary,listening to investors is essential to good governance and annual andto the long-term incentives to attract and retain highly qualified executives and maintains a strong relationship between executive compensation and performance, thereby aligning the interests of the Corporation's executive officers with those of its stockholders. As evidenced by the resultssustainability of our "say-on-pay" vote atcompany. Our senior management is open and accessible. As such, we want to engage with and listen to our 2014 Annual Meeting of Stockholders, with over 97% of the shares voted being votedinvestors and sell-side analysts in favor of the proposal,order to have productive conversations in which we believe that stockholders have indicated strong support for the structurereview our strategic objectives, operations and execution of our named executive officer compensation program. The Board recommends a voteFOR this proposal.

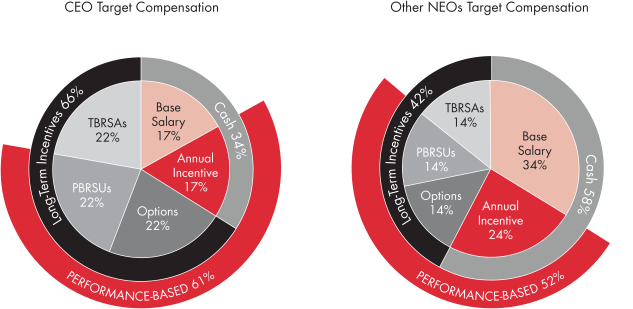

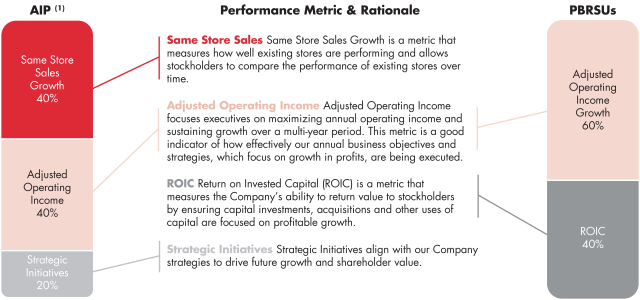

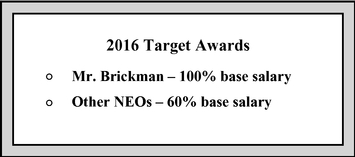

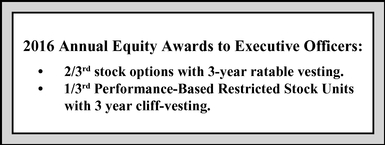

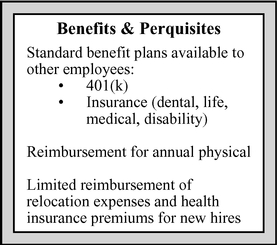

progress, and listen to their feedback. FY19 Executive Compensation Highlights Highlights of our named executive officerNamed Executive Officer compensation program, as described in the Compensation Discussion and Analysis section on page 40, include:

This advisory (non-binding) resolution regarding the compensation of the Corporation's named executive officers, including the Corporation's compensation practices and principles and their implementation, as disclosed in this Proxy Statement, requires the affirmative vote of a majority of the votes cast at the meeting. The Board recommends a voteFOR this proposal.requirements www.sallybeautyholdings.com 9

iii

Proposal 3 — Frequency of Advisory Votes on Executive Compensation (see page 67)

We are asking stockholders to approve on an advisory (non-binding) basis, how frequently the advisory votes on executive compensation, such as Proposal 2, will occur.

This advisory proposal requires a plurality of the votes cast for one of the three options presented at the meeting. The frequency option which receives the most affirmative votes of all the votes cast at the meeting is the one that will be deemed approved by the stockholders. Stockholders may select from the following options: 1 year, 2 years or 3 years. The Board recommends a vote for1 YEAR.

iv

Proposal 4 — Ratification of Independent Auditors (see page 68)

Although stockholder ratification is not required by law, we are asking stockholders to ratify the selection of KPMG LLP as our independent registered public accounting firm for fiscal 2017. Set forth below is summary information with respect to KPMG LLP's fees for services provided in fiscal 2015 and fiscal 2016. The Board recommends a voteFOR this proposal.

| | | | | | | | |

| | 2016 | 2015 | |||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

| Audit Fees | $ | 2,351,143 | $ | 2,606,569 | |||

| | | | | | | | |

| Audit Related Fees | — | — | |||||

| | | | | | | | |

| Tax Fees | $ | 786,596 | $ | 849,463 | |||

| | | | | | | | |

| All Other Fees | — | — | |||||

| | | | | | | | |

| Total | $ | 3,137,739 | $ | 3,456,032 | |||

| | | | | | | | |

2018 Annual Meeting

v

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

vi

Sally Beauty Holdings, Inc.3001 Colorado Boulevard, Denton, Texas 76210

Annual Meeting of Stockholders

January 26, 2017

This Proxy Statement is being furnished by Sally Beauty Holdings, Inc. ("we," "us," or the "Corporation") in connection with a solicitation of proxies by our Board of Directors to be voted at our annual meeting of stockholders to be held on January 26, 2017. Whether or not you personally attend, it is important that your shares be represented and voted at the annual meeting. Most stockholders have a choice of voting over the Internet, by using a toll-free telephone number, or by completing a proxy card and mailing it in the postage-paid envelope provided. Check your proxy card or the information provided to you by your bank, broker, or other stockholder of record to determine which voting options are available to you. The Internet voting and telephone voting facilities for stockholders of record will be available until 1:00 a.m., local time, on January 26, 2017. This Proxy Statement and the accompanying proxy card were first mailed on or about December 9, 2016.

SOLICITATION AND RATIFICATION OF PROXIES

If the enclosed form of proxy card is signed and returned, it will be voted as specified in the proxy, or, if no vote is specified, it will be voted "FOR" all nominees presented in Proposal 1, "FOR" the proposal set forth in Proposal 2, for the "1 YEAR" option set forth in Proposal 3 and "FOR" the proposal set forth in Proposal 4. If any matters that are not specifically set forth on the proxy card and in this Proxy Statement properly come to a vote at the meeting, the proxy holders will vote on such matters in accordance with their best judgments. At any time before the annual meeting, you may revoke your proxy by timely delivery of written notice to our Corporate Secretary, by timely delivery of a properly executed, later-dated proxy (including an Internet or telephone vote), or by voting via ballot at the annual meeting. Voting in advance of the annual meeting will not limit your right to vote at the annual meeting if you decide to attend in person. If you are a beneficial owner, but your shares are registered in the name of a bank, broker, or other stockholder of record, the voting instructions form mailed to you with this Proxy Statement may not be used to vote in person at the annual meeting. Instead, to be able to vote in person at the annual meeting you must obtain, from the stockholder of record, a proxy in your name and present it at the meeting. See "Questions and Answers about the Meeting and Voting" in this Proxy Statement for an explanation of the term "stockholder of record."

The proxy accompanying this Proxy Statement is being solicited by our Board of Directors. We will bear the entire cost of this solicitation, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy, and any additional information furnished to our stockholders. In addition to using the mail, proxies may be solicited by directors, executive officers, and other employees of the Corporation, in person or by telephone. No additional compensation will be paid to our directors, executive officers, or other employees for these services. We will also request banks, brokers, and other stockholders of record to forward proxy materials, at our expense, to the beneficial owners of our Common Stock. We have retained Alliance Advisors, LLC to assist us with the solicitation of proxies for an estimated fee of approximately $7,500, plus normal expenses not expected to exceed $13,500.

OUTSTANDING STOCK AND VOTING PROCEDURES

Outstanding Stock

The stockholders of record of our Common Stock at the close of business on December 1, 2016 will be entitled to vote in person or by proxy at the annual meeting. At that time, there were 143,563,902 shares of our Common Stock outstanding. Each stockholder will be entitled to one vote in person or by proxy for each share of Common Stock held.

If you hold shares through an account with a bank, broker or other similar holder of record, the voting of the shares by the bank, broker or other similar holder of record when you do not provide voting instructions is governed by the rules of the New York Stock Exchange ("NYSE"). These rules allow banks, brokers and other similar holders of record to vote shares in their discretion on "routine" matters for which their customers do not provide voting instructions. On matters considered "non-routine," banks, brokers and other similar holders of record may not vote shares (referred to as "broker non-votes") without your instruction.

Proposal 4 (the ratification of KPMG LLP as our independent registered public accounting firm for our 2017 fiscal year) is considered a routine matter. Accordingly, banks and brokers may vote shares on this proposal without your instructions.

However, Proposal 1 (election of directors), Proposal 2 (approval of an advisory resolution regarding the compensation of the Corporation's named executive officers, including the Corporation's compensation practices and principles and their implementation, as disclosed in this Proxy Statement), and Proposal 3 (expression of the views of the stockholders on how frequently advisory votes on executive compensation, such as Proposal 2, will occur) are considered non-routine, and banks, brokers and other similar holders of record therefore cannot vote shares on these proposals without your instructions. Please note that if your shares are held through a bank, broker or other similar holder of record and you want your vote to be counted on this proposal, you must instruct your bank or broker how to vote your shares.

Quorum

A quorum for the transaction of business will be present if the holders of a majority of our Common Stock issued and outstanding and entitled to be cast thereat are present, in person or by proxy, at the annual meeting. Your shares are counted as present if you attend the annual meeting and vote in person or if you properly return a proxy over the Internet, by telephone or by mail. Abstentions and broker non-votes will be counted for purposes of establishing a quorum. If a quorum is not present at the annual meeting, the annual meeting may be adjourned from time to time until a quorum is present.

Voting Procedures

Votes cast by proxy or in person at the meeting will be tabulated by the Inspector of Election from Computershare Trust Company, N.A. In addition, the following voting procedures will be in effect for each proposal described in this Proxy Statement:

Proposal 1. Nominees for available director positions must be elected by a plurality of the votes cast in person or by proxy at the annual meeting. Withheld votes and broker non-votes will have no effect in determining whether the proposal has been approved.

Proposal 2. The advisory (non-binding) resolution to approve the compensation of the Corporation's named executive officers, including the Corporation's compensation practices and principles and their implementation, as disclosed in this Proxy Statement, requires the affirmative vote

of a majority of the votes cast in person or by proxy at the annual meeting. Abstentions and broker non-votes will have no effect in determining whether the proposal has been approved.

Proposal 3. The advisory proposal regarding how frequently advisory votes on executive compensation, such as Proposal 2, will occur, requires a plurality of the votes cast for the three options presented at the annual meeting. The frequency option which receives the most affirmative votes of all the votes cast in person or by proxy at the annual meeting is the one that will be deemed approved by the stockholders. Abstentions and broker non-votes will have no effect in determining whether any frequency option in the proposal has been approved.

Proposal 4. Ratification of the appointment of KPMG LLP as our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast in person or by proxy at the annual meeting. Abstentions will have no effect in determining whether this proposal has been approved. Since this proposal is considered a routine matter, there will be no broker non-votes with respect to this proposal.

If any other matters properly come before the meeting that are not specifically set forth on the proxy card and in this Proxy Statement, such matters shall be decided by a majority of the votes cast at the annual meeting, unless otherwise provided in our Third Restated Certificate of Incorporation ("Certificate of Incorporation"), Sixth Amended and Restated By-Laws ("By-Laws"), the Delaware General Corporation Law or the rules and regulations of the New York Stock Exchange. None of the members of our Board have informed us in writing that they intend to oppose any action intended to be taken by us.

NO PERSON IS AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS OTHER THAN THOSE CONTAINED IN THIS PROXY STATEMENT, AND, IF GIVEN OR MADE, SUCH INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED. THE DELIVERY OF THIS PROXY STATEMENT SHALL, UNDER NO CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN OUR AFFAIRS SINCE THE DATE OF THIS PROXY STATEMENT.

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING

1. What is a proxy?

A proxy is your legal designation of another person, called a proxy holder, to vote the shares that you own. If you designate someone as your proxy holder in a written document, that document is called a proxy. We have designated Shannon Barcroft, our Vice President of Compensation and Benefits, and Janna Minton, our Group Vice President, interim Chief Financial Officer, Chief Accounting Officer and Controller, to act as proxy holders at the annual meeting as to all shares for which proxies are returned or voting instructions are provided by Internet or telephonic voting.

2. What is a proxy statement?

A proxy statement is a document that SEC regulations require us to give you when we ask you to sign a proxy card designating the proxy holders described above to vote on your behalf.

3. What is the difference between a stockholder of record and a stockholder who holds stock in street name, also called a "beneficial owner?"

4. How do you obtain an admission ticket to personally attend the annual meeting?

Please note that whether you are a stockholder of record or street name holder, you will also need to bring a government-issued photo identification card to gain admission to the annual meeting.

5. What different methods can you use to vote?

Stockholders of Record. If your shares are registered in your own name, you may vote by proxy or in person at the annual meeting. To vote by proxy, you may select one of the following options:

Street Name Holders. If your shares are held in the name of a bank, broker or other similar holder of record, you will receive instructions from such holder of record that you must follow for your shares to be voted. Please follow their instructions carefully. Also, please note that if the holder of record of your shares is a broker, bank or other nominee and you wish to vote in person at the annual meeting, you must request a legal proxy or broker's proxy from such record holder that holds your shares and present that proxy and proof of identification at the annual meeting.

See question 4 for a further description of how to obtain a legal proxy if your shares are held in street name.

6. What is the record date and what does it mean?

The record date for the annual meeting is December 1, 2016. The record date is established by our Board of Directors as required by Delaware law. Stockholders of record at the close of business on the record date are entitled to receive notice of the annual meeting and to vote their shares at the meeting.

7. What are your voting choices for director nominees, and what vote is needed to elect directors?

For the vote on the election of the director nominees to serve until the 2018 annual meeting, stockholders may:

Directors will be elected by a plurality of the votes cast in person or by proxy at the annual meeting. The Board recommends a vote "FOR" each of the director nominees.

8. What is a plurality of the votes?

In order to be elected, a director nominee does not have to receive a majority of the affirmative votes cast for directors. Instead, the nine nominees elected are those who receive the most affirmative votes of all the votes cast on Proposal 1 in person or by proxy at the meeting.

9. What are your voting choices on the proposal inviting stockholders to approve the advisory (non-binding) resolution endorsing the compensation of the Corporation's executive officers, including the Corporation's compensation practices and principles and their implementation, as discussed in this Proxy Statement?

In the vote on the advisory (non-binding) resolution to approve the compensation of the Corporation's executive officers, including the Corporation's compensation practices and principles and their implementation, as discussed and disclosed in this Proxy Statement, stockholders may:

The advisory resolution to approve the Corporation's executive compensation program will require the affirmative vote of a majority of the votes cast in person or by proxy at the annual meeting. This is an advisory vote, and as such is not binding on the Board. The Board recommends a vote "FOR" Proposal 2.

10. What are your voting choices on the proposal inviting stockholders to express a preference as to the frequency of an advisory vote on executive compensation?

Stockholders are invited to express their views on how frequently advisory votes on executive compensation, such as Proposal 2, will occur. Stockholders can advise the Board on whether such votes should occur every:

This is an advisory vote, and as such is not binding on the Board. However, the Board will take the results of the vote into account when deciding when to call for the next advisory vote on executive compensation. A scheduling vote similar to this will occur at least once every six years. The Board recommends a vote for "1 YEAR" for Proposal 3. Stockholders are not being asked to approve or disapprove of the Board's recommendation, but rather to indicate their own choice as among the frequency options.

11. What are your voting choices on the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the 2017 fiscal year, and what vote is needed to ratify their appointment?

In the vote on the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the 2017 fiscal year, stockholders may:

The proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm will require the affirmative vote of a majority of the votes cast in person or by proxy at the annual meeting. The Board recommends a vote "FOR" Proposal 4.

12. What if a stockholder does not specify a choice for a matter when returning a proxy?

Stockholders should specify their choice for each proposal described on the enclosed proxy. However, proxies that are signed and returned will be voted "FOR" Proposals 1, 2, and 4 and for "1 YEAR" for Proposal 3, if no specific instructions are given on such proposals.

13. How are abstentions and broker non-votes counted?

Both abstentions and broker non-votes are counted as "present" for purposes of determining the existence of a quorum at the annual meeting. Abstentions (or, with respect to Proposal 1, withheld votes) will not be included in vote totals and will not affect the outcome of the vote on Proposals 1, 2, 3, or 4. Broker non-votes will not be included in vote totals and will not affect the outcome of the vote on Proposals 1, 2, and 3. Proposal 4 is considered a routine matter and accordingly there will be no broker non-votes with respect to this proposal.

14. How will stockholders know the outcome of the proposals considered at the annual meeting?

We will announce preliminary results at the annual meeting. We will report final results athttp://investor.sallybeautyholdings.com and in a filing with the U.S. Securities and Exchange Commission on Form 8-K.

PROPOSAL 1 —- ELECTION OF DIRECTORS

Our current Board of Directors consists of nineeleven individuals, eightten of whom qualify as independent of us under the rules of the NYSE. The Board of Directors, acting pursuant to our By-laws, is proposing two new nominees (Timothy R. Baer & Dorlisa K. Flur), with David W. Gibbs not standing for re-election. Our Certificate of Incorporation and our By-Laws provide for the annual election of each of our directors for one-year terms.

On August 1, 2016, in light of the retirement of Mr. Gary G. Winterhalter, and the appointments of Mr. Gibbs in March 2016 and Ms. Nealy Cox in August 2016, the Board of Directors, acting pursuant to the By-Laws, changed the size of the Board of Directors to nine members.

Following the recommendations of our Nominating, Governance and Corporate GovernanceResponsibility Committee, our Board of Directors has nominated Mr. Brickman, Ms. Button Bell, Ms. Nealy Cox,Mr. Baer, Mr. Eisenberg, Mr. Gibbs,Ms. Ferguson, Ms. Flur, Ms. Heasley, Mr. McMaster, Mr. Miller, Ms. Mooney, Ms. Mulder, Ms. Paulonis and Mr. Rabin for reelectionelection to our Board of Directors. Accordingly, this Proposal 1 seeks the reelectionelection of these ninetwelve individuals to be directors, toeach with a one-year term that will expire at the annual meeting of stockholders in 2018.

2021. Unless otherwise indicated, all proxies that authorize the proxy holders to vote for the election of directors will be voted "FOR"“FOR” the election of the nominees listed below. If a nominee becomes unavailable for election as a result of unforeseen circumstances, it is the intention of the proxy holders to vote for the election of such substitute nominee, if any, as the Board of Directors may propose. As of the date of this Proxy Statement, each of the nominees has consented to serve and the Board is not aware of any circumstances that would cause a nominee to be unable to serve as a director.

Each of Except for Mr. Brickman,Baer and Ms. Button Bell, Ms. Nealy Cox, Mr. Eisenberg, Mr. Gibbs, Mr. McMaster, Mr. Miller, Ms. Mulder and Mr. RabinFlur who are standing for election to our Board for the first time, each director nominee is a current directorsdirector with a term expiring at this annual meeting and eachmeeting. Each director nominee has furnished to us the following information with respect to their principal occupation or employment and principal directorships:

Christian A. Brickman Director, President and Chief Executive Officer, age 51.55 Mr. Brickman has served on our Board of Directors since September 2012 and is the Corporation'sCorporation’s President and Chief Executive Officer, a role he has held since February 2015. Prior to being appointed to his current role, Mr. Brickman served as President and Chief Operating Officer of the Corporation from June 2014 to February 2015. Prior to joining the Corporation, Mr. Brickman served as President of Kimberly-Clark International from May 2012 to February 2014, where he led the Corporation's international consumer business in all operations. From August 2010 to May 2012, Mr. Brickman served as President of Kimberly-Clark Professional. From 2008 to 2010, Mr. Brickman served as Chief Strategy Officer of Kimberly-Clark and played a key role in the development and implementation of Kimberly-Clark's strategic plans and processes to enhance enterprise growth initiatives. Prior to joining Kimberly-Clark, Mr. Brickman was a Principal in McKinsey & Company's Dallas, Texas office and a leader in the firm's consumer packaged goods and operations practices. Before joining McKinsey, Mr. Brickman was President and CEO of Whitlock Packaging, the largest non-carbonated beverage co-packing company in the United States, from 1998 to 2001. From 1994 to 1998, he was with Guinness/United Distillers, initially as Vice President of Strategic Planning for the Americas region and then as General Manager for Guinness Brewing Worldwide's Latin America region. Mr. Brickman was awarded an advanced bachelor's degree in economics in 1986 from Occidental College in Los Angeles where he graduated with honors, Phi Beta Kappa and cum laude.2014. We believe that Mr. Brickman'sBrickman’s executive and management experience, including his experience as President of two large international companies, well qualifyqualifies him to serve on our Board. 10 SALLYBEAUTY HOLDINGS, INC. 2019 Proxy Statement

Katherine Button Bell,PROPOSAL 1 - ELECTION OF DIRECTORS Timothy R. Baer Director Nominee, age 58. Ms. Button Bell59 Mr. Baer founded and has been Managing Partner of TRB Partners LLC since 2017 and of TRB Law PPLC since 2019. In addition, Mr. Baer has served on our BoardasCo-Chair of Directorsthe PJT Camberview Advisory Council since March 20132017. From 2016 to 2017 Mr. Baer was Senior Advisor to Target Corporation and isfrom 2004 to 2016 he was Target’s Executive Vice President, Chief Legal Officer and Chief Marketing Officer of Emerson Electric Company, a diversified global manufacturing and technology company. Ms. Button Bell joined Emerson in 1999 and provides strategic leadership for the company's global marketing, corporate branding, and digital customer experience initiatives. She also oversees corporate communications, market research, and professional development for the company's marketing teams worldwide. In this capacity, Ms. Button

Bell played a key role in the launch of Emerson's corporate branding program, building Emerson's brand globally. Prior to joining Emerson, Ms. Button Bell was the President of Button Brand Development, Inc., an independent marketing consulting firm specializing in developing well-recognized companies' brand names. Ms. Button BellCorporate Secretary. Mr. Baer has been a director of Johnson Outdoors Inc., a NASDAQ listed manufacturer of outdoor recreation equipment, since September 2014, and was a director of Furniture Brands International, Inc. from 1997 to May 2008. She alsopreviously served as a director of the Business Marketing Association from 2013 to 2014. She currently serves on the marketing/strategy committee of St. Louis Children's Hospital,board member for Greater MSP and is a member of the board of trustees of the St. Louis Art Museum.Greater Twin Cities United Way. We believe that Ms. Button Bell's executiveMr. Baer’s legal and management experience well qualify herqualifies him to serve on our Board.

Erin Nealy Cox, Director, age 46. Ms. Nealy Cox has served on our Board of Directors since August 2016. Ms. Nealy Cox served as an Executive Managing Director at Stroz Friedberg, LLC from 2010 until May 2016, where she led the Incident Response Unit. In this role, Ms. Nealy Cox led a global team of first responders, threat intelligence analysts and malware specialists, assisting corporate clients affected by cyber-attacks, state-sponsored espionage and data breach cases to solve complex and high profile cyber-breaches. Prior to her appointment as the head of the Incident Response Unit, from 2010 to 2012, Ms. Nealy Cox led Stroz Friedberg's Central Division, where she was responsible for oversight of the digital forensic laboratories, examiners and staff throughout the entire region. Stroz Friedberg has provided various cyber-security services to the Company. Prior to her career at Stroz Friedberg, Ms. Nealy Cox worked for the Department of Justice as an Assistant United States Attorney for the Northern District of Texas, and from 2004 to 2005, she served as Chief of Staff to the Assistant Attorney General in the Office of Legal Policy in Washington, D.C. Ms. Nealy Cox serves on the Financial Committee of the Perot Museum of Nature and Science and was formerly a director of the Dallas Children's Advocacy Center and the Volunteer Center of Texas. Ms. Nealy Cox graduated with a BBA in Finance from University of Texas at Austin and a JD from SMU School of Law. We believe that Ms. Nealy Cox's extensive cyber-security, management and legal experience well qualifies her to serve on our Board.

Marshall E. Eisenberg Director, age 71.74 Mr. Eisenberg has served on our Board of Directors since November 2006. Mr. Eisenberg is a founding partner of the Chicago law firm of Neal, Gerber & Eisenberg LLP and has been a member of the firm'sfirm’s Executive Committee for the past 30 years. Mr. Eisenberg is a director ofJel-Sert Company and was formerly a director of Ygomi, Inc. and Engineered Controls International, Inc. Mr. Eisenberg has served on the Board of Visitors of the University of the Illinois College of Law. Mr. Eisenberg received his J.D. degree with honors from the University of Illinois College of Law in 1971, where he served as a Notes and Comments Editor of the Law Review and was elected to the Order of the Coif. We believe that Mr. Eisenberg'sEisenberg’s extensive legal experience, including his extensive corporate governance experience, well qualifies him to serve on our Board.

David W. Gibbs, Diana S. Ferguson Director, age 53.56 Ms. Ferguson was elected to our Board of Directors in January 2019. She has served as a consultant to Cleveland Avenue, LLC, a venture capital investment firm, since September 2015, and in 2018 became its Chief Financial Officer. In addition, Ms. Ferguson has served as a principal of Scarlett Investments, LLC, a private investment firm, since 2013. She also served as Chief Financial Officer of the Chicago Board of Education from February 2010 to May 2011 and as Senior Vice President and Chief Financial Officer of The Folgers Coffee Company from April 2008 to November 2008 when Folgers was sold. Prior to joining Folgers, she was Executive Vice President and Chief Financial Officer of Merisant Worldwide, Inc. Ms. Ferguson also served as the Chief Financial Officer of Sara Lee Foodservice, a division of Sara Lee Corporation, and in a number of leadership positions at Sara Lee Corporation, including Senior Vice President of Strategy and Corporate Development, as well as Treasurer. We believe that Ms. Ferguson’s executive, management and finance experience well qualifies her to serve on our Board. www.sallybeautyholdings.com 11

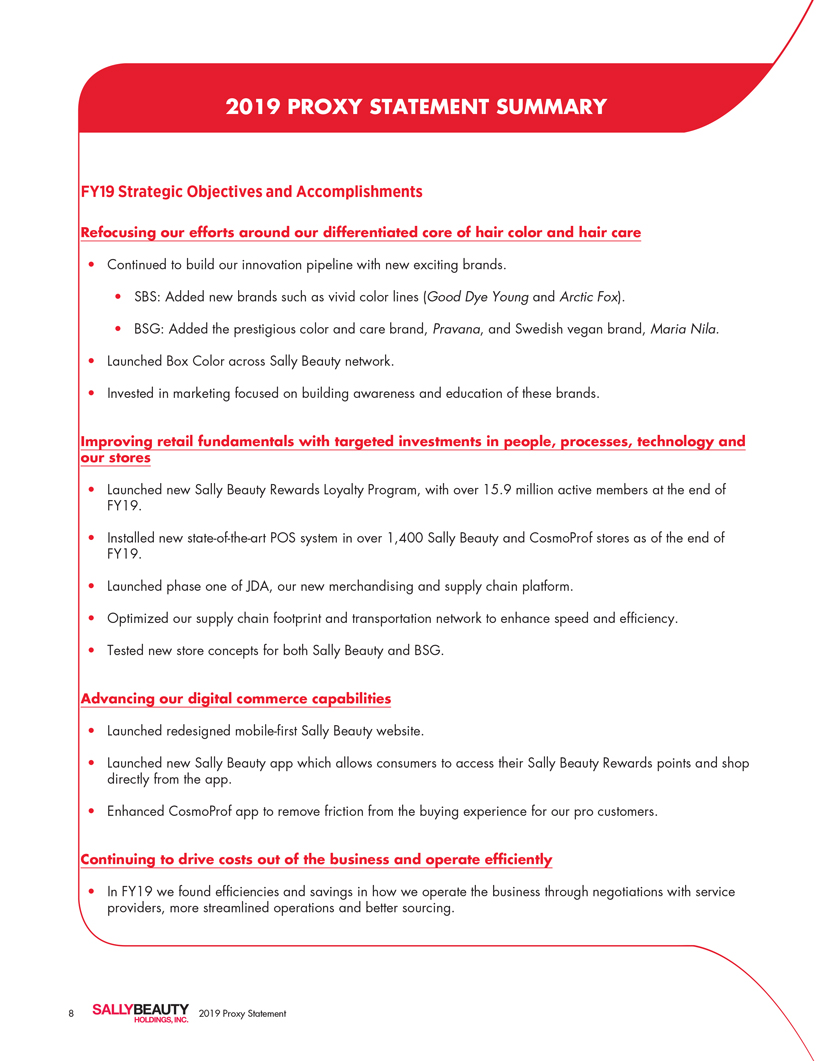

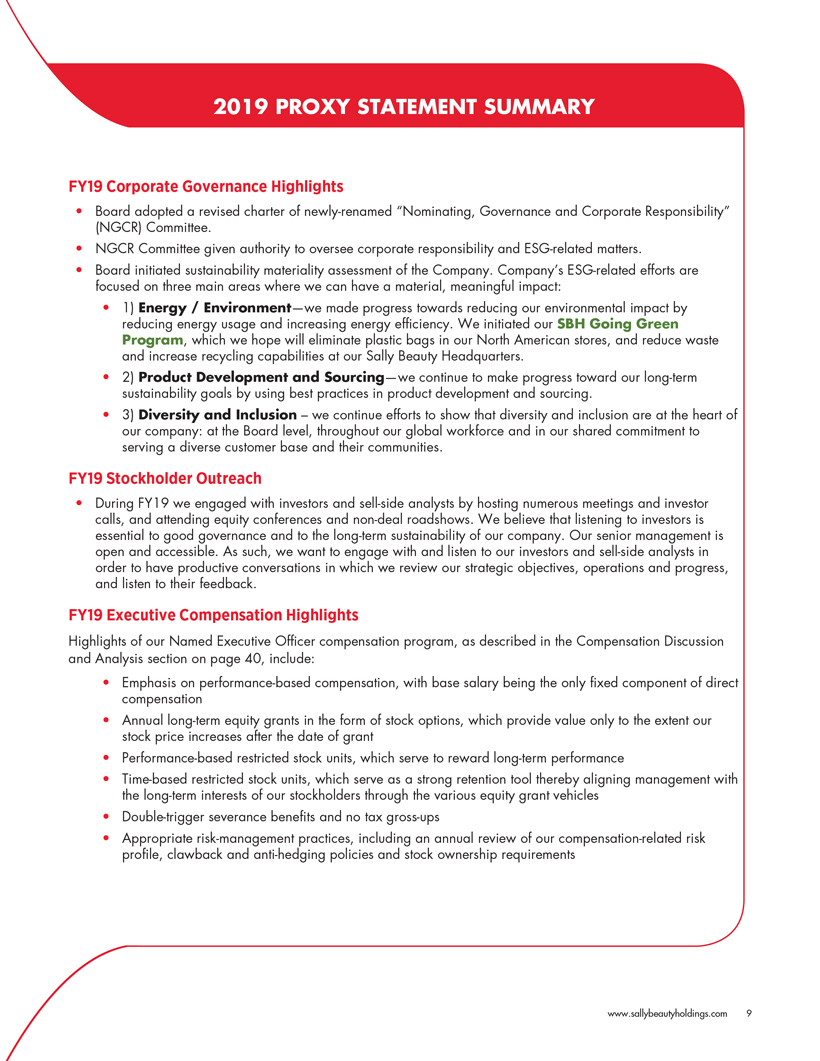

Mr. GibbsPROPOSAL 1 - ELECTION OF DIRECTORS Dorlisa K. Flur Director Nominee, age 54 Ms. Flur has served as senior advisor to Southeastern Grocers, Inc. since August 2018 and was previously its Chief Strategy and Transformation Officer from August 2016 to July 2018. Prior to that Ms. Flur served as Executive Vice President, Omnichanel for Belk, Inc. from February 2013 to January 2016, where she integrated stores and eCommerce and also led supply chain. She was previously Vice Chair, Strategy and Chief Administrative Officer at Family Dollar Stores, Inc. where she held a series of top operational roles including real estate, marketing and merchandising as the company scaled from 5000 to 7500 stores. Ms. Flur is a former partner of McKinsey & Company, Inc. where sheco-led its Charlotte, North Carolina office. She currently serves as a director of Hibbett Sports, Inc., where she is a member of its Audit Committee, and United States Cold Storage, a wholly-owned subsidiary of John Swire & Sons, Inc. We believe that Ms. Flur’s executive and management experience, including extensive work driving transformations within mass market retail, well qualifies her to serve on our Board. Linda Heasley Director, age 64 Ms. Heasley has served on our Board of Directors since March 2016. Mr. Gibbs is the PresidentMay 2017 and was Chief FinancialExecutive Officer of Yum! Brands,J.Jill, Inc. from April 2018 until December 2019. Before joining J.Jill, Inc., a position he has held since 2016. In this capacity, Mr. Gibbs has global responsibility for finance, operations, supply chain and information technology for the company. Prior to his current position, Mr. GibbsMs. Heasley served as the Chief Executive Officer of Pizza Hut, a division of Yum! Brands and one ofThe Honey Baked Ham Company, LLC from February 2017 to March 2018. Ms. Heasley served as the world's largest global casual dining chains, a position he held from 2015 to 2016. At Pizza Hut, Mr. Gibbs was responsible for overseeing the Pizza Hut organization, including the development of a global growth strategy. Mr. Gibbs joined the restaurant division of Pepsico in 1989, which later became part of Yum! Brands, and served in a variety of executive roles with Yum! Brands, including Chief StrategyExecutive Officer and President of Lane Bryant, Inc. from February 2013 until February 2017 and as the Chairman, President and Chief Financial Officer of Yum! Restaurants International.Executive Officer. Prior to this, Ms. Heasley held senior leadership roles at CVS Health Corporation, Timberland LLC, Bath and Body Works and L Brands, Inc. She currently serves as a director at J.Jill, Inc. We believe that Mr. GibbsMs. Heasley’s executive management and financemanagement experience well qualifies himher to serve on our Board.

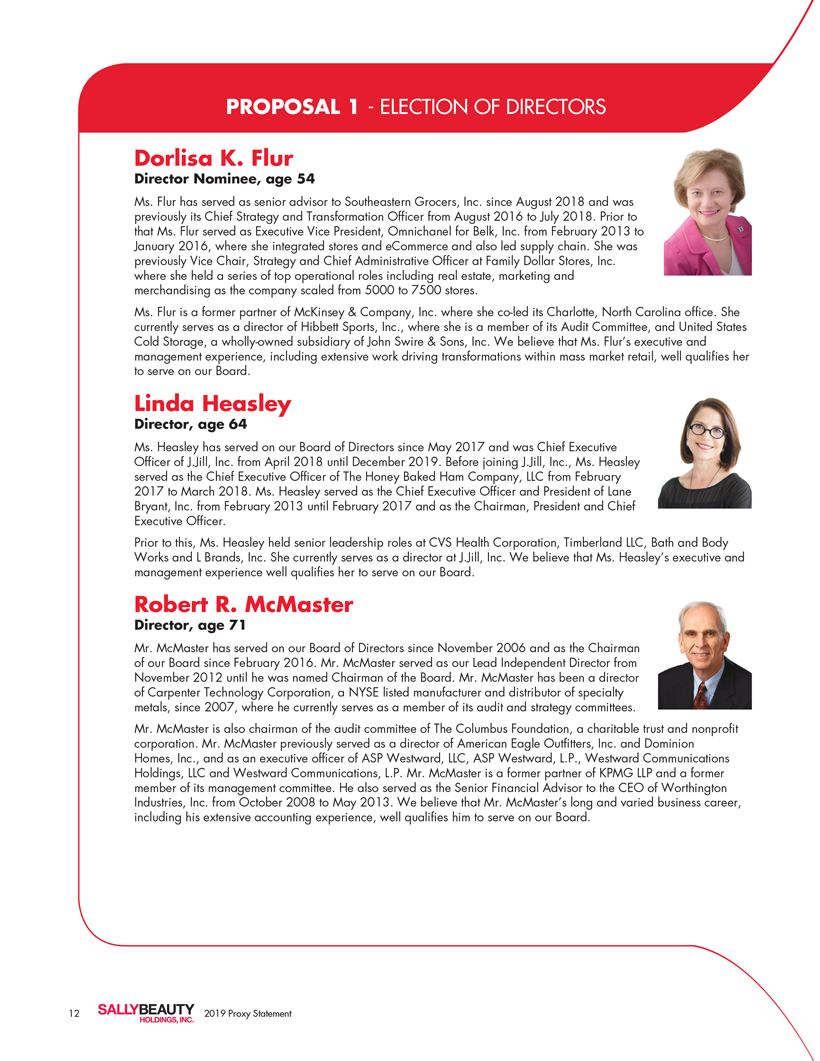

Robert R. McMaster Director, age 68.71 Mr. McMaster has served on our Board of Directors since November 2006 and as ourthe Chairman of theour Board since February 2016. Prior to his appointment as Chairman of the Board, Mr. McMaster served as our Lead Independent Director sincefrom November 2012.2012 until he was named Chairman of the Board. Mr. McMaster has been a director of Carpenter Technology Corporation, a NYSE listed manufacturer and distributor of specialty metals, since 2007, where he currently serves as a member of its audit and strategy committees. Mr. McMaster is also chairman of the audit committee of The Columbus Foundation, a charitable trust and nonprofit corporation. From May 2003 until June 2006, Mr. McMaster previously served as a director of American Eagle Outfitters, Inc. and as chairman of its audit committee and a member of its compensation committee. Mr. McMaster was a director and a member of the audit and compensation committees of Dominion Homes, Inc. from May 2006 to May 2008. From January 2003 until February 2005, Mr. McMaster served, and as Chief Executive Officeran executive officer of ASP Westward, LLC, and ASP Westward, L.P. and from June 1997 until December 2002, Mr. McMaster served as Chief Executive Officer of, Westward Communications Holdings, LLC and Westward Communications, L.P. Mr. McMaster is a former partner of KPMG LLP and a former member of its management committee. He also served as the Senior Financial Advisor to the CEO of Worthington Industries, Inc. from October 2008 to May 2013. We believe that Mr. McMaster'sMcMaster’s long and varied business career, including his extensive accounting experience, well qualifies him to serve on our Board. 12 SALLYBEAUTY HOLDINGS, INC. 2019 Proxy Statement

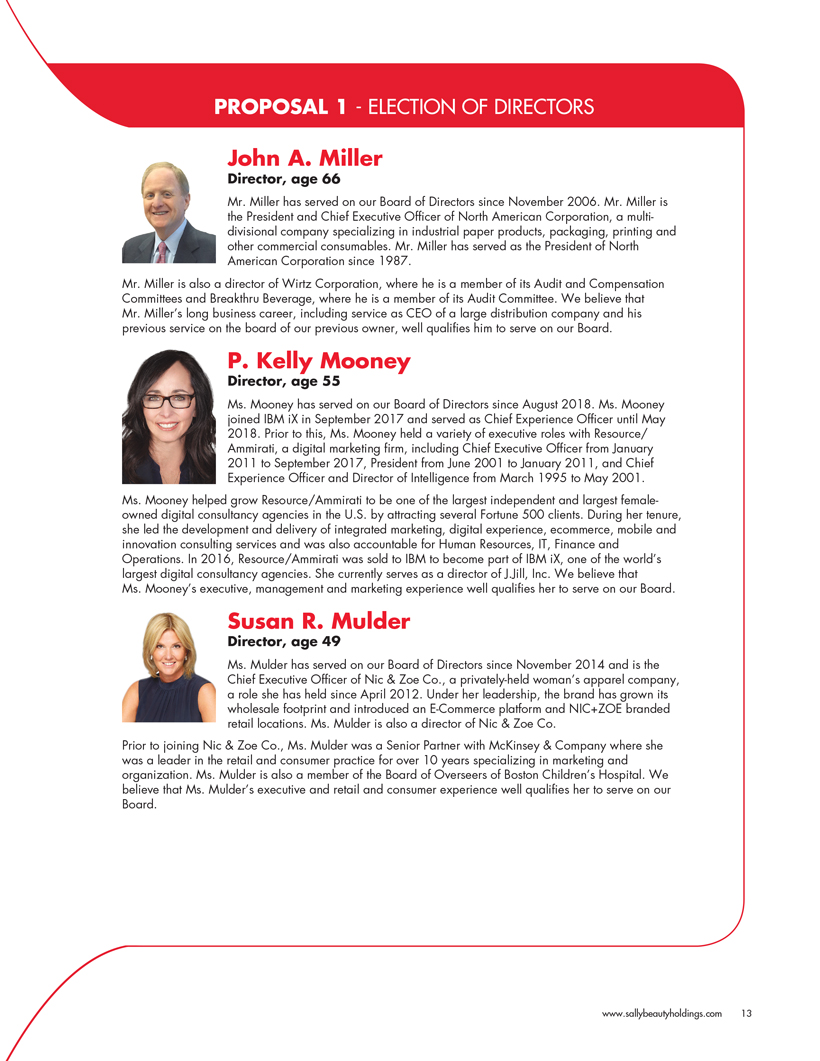

PROPOSAL 1 - ELECTION OF DIRECTORS John A. Miller Director, age 63.66 Mr. Miller has served on our Board of Directors since November 2006. Mr. Miller is the President and Chief Executive Officer of North American Corporation, a multi-divisional company specializing in industrial paper products, packaging, printing and other commercial consumables. Mr. Miller has served as the President of North American Corporation since 1987. Mr. Miller is also a director of Wirtz Corporation, where he is a member of its Audit and Compensation Committees;Committees and Breakthru Beverage, where he is a member of its Audit Committee; and Laureate Education, Inc.Committee. We believe that Mr. Miller'sMiller’s long business career, including service as CEO of a large distribution company and his previous service on the board of our previous owner, well qualifies him to serve on our Board.

P. Kelly Mooney Director, age 55 Ms. Mooney has served on our Board of Directors since August 2018. Ms. Mooney joined IBM iX in September 2017 and served as Chief Experience Officer until May 2018. Prior to this, Ms. Mooney held a variety of executive roles with Resource/Ammirati, a digital marketing firm, including Chief Executive Officer from January 2011 to September 2017, President from June 2001 to January 2011, and Chief Experience Officer and Director of Intelligence from March 1995 to May 2001. Ms. Mooney helped grow Resource/Ammirati to be one of the largest independent and largest female-owned digital consultancy agencies in the U.S. by attracting several Fortune 500 clients. During her tenure, she led the development and delivery of integrated marketing, digital experience, ecommerce, mobile and innovation consulting services and was also accountable for Human Resources, IT, Finance and Operations. In 2016, Resource/Ammirati was sold to IBM to become part of IBM iX, one of the world’s largest digital consultancy agencies. She currently serves as a director of J.Jill, Inc. We believe that Ms. Mooney’s executive, management and marketing experience well qualifies her to serve on our Board. Susan R. Mulder Director, age 45.49 Ms. Mulder has served on our Board of Directors since November 2014 and is the Chief Executive Officer of Nic & Zoe Co., a privately-held woman'swoman’s apparel company, a role she has held since April 2012. Under her leadership, the brand has not only grown its wholesale footprint but has alsoand introduced anE-Commerce platform and NIC+ZOE branded retail locations. Ms. Mulder is also a director of Nic & Zoe Co. Prior to joining Nic & Zoe Co., Ms. Mulder was a Senior Partner with McKinsey & Company where she was a leader in the retail and consumer practice for over 10 years specializing in marketing and organization. Ms. Mulder is also a member of the Board of Overseers of Boston Children'sChildren’s Hospital. Ms. Mulder received her MBA from the Harvard Business School with distinction in 1996, and holds a Bachelor of Commerce degree with great distinction from McGill University in Montreal, Quebec. We believe that Ms. Mulder'sMulder’s executive and retail and consumer experience well qualifyqualifies her to serve on our Board. www.sallybeautyholdings.com 13

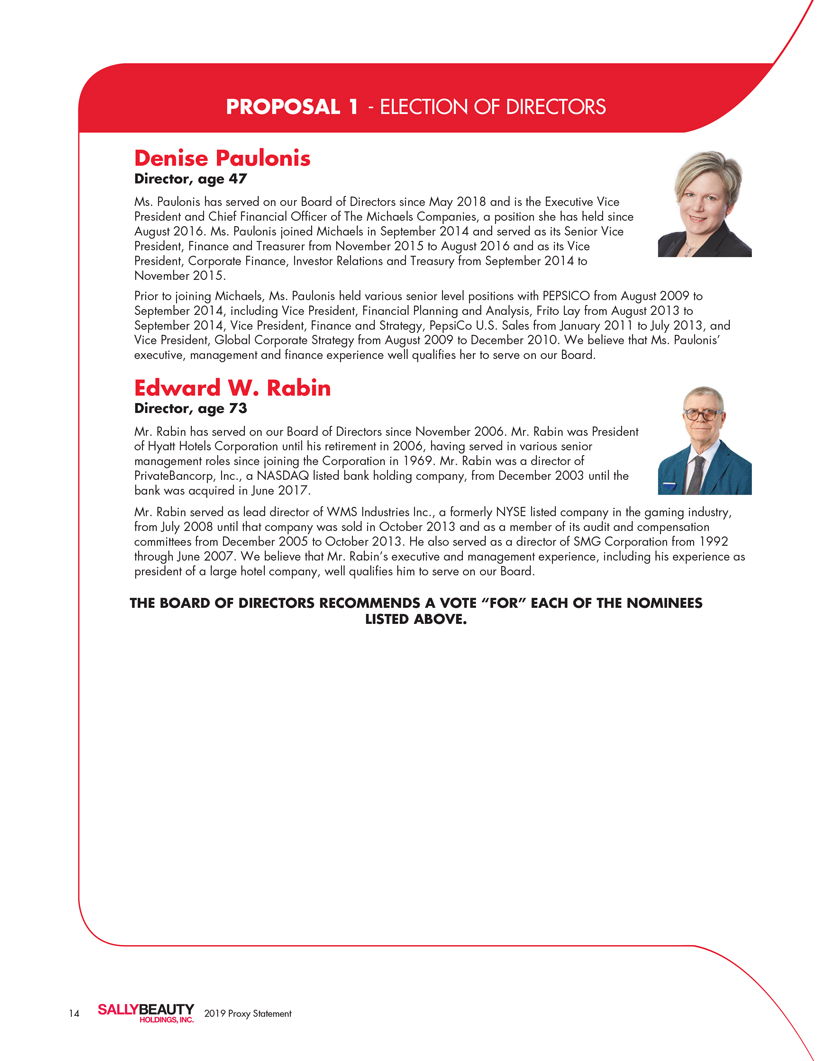

PROPOSAL 1 - ELECTION OF DIRECTORS Denise Paulonis Director, age 47 Ms. Paulonis has served on our Board of Directors since May 2018 and is the Executive Vice President and Chief Financial Officer of The Michaels Companies, a position she has held since August 2016. Ms. Paulonis joined Michaels in September 2014 and served as its Senior Vice President, Finance and Treasurer from November 2015 to August 2016 and as its Vice President, Corporate Finance, Investor Relations and Treasury from September 2014 to November 2015. Prior to joining Michaels, Ms. Paulonis held various senior level positions with PEPSICO from August 2009 to September 2014, including Vice President, Financial Planning and Analysis, Frito Lay from August 2013 to September 2014, Vice President, Finance and Strategy, PepsiCo U.S. Sales from January 2011 to July 2013, and Vice President, Global Corporate Strategy from August 2009 to December 2010. We believe that Ms. Paulonis’ executive, management and finance experience well qualifies her to serve on our Board. Edward W. Rabin Director, age 70.73 Mr. Rabin has served on our Board of Directors since November 2006. Mr. Rabin was President of Hyatt Hotels Corporation until his retirement in 2006, having served in various senior management roles since joining the Corporation in 1969. Mr. Rabin iswas a director of PrivateBancorp, Inc., a NASDAQ listed bank holding company, and serves on its audit committee and chairs its compensation committee. He also currently serves as a member offrom December 2003 until the Board of Advisors of First Hospitality Group, Inc., a private company.bank was acquired in June 2017. Mr. Rabin served as lead director of WMS Industries Inc., a formerly NYSE listed company in the gaming industry, from July 2008 until that company was sold in October 2013 and as a member of its audit and compensation committees from December 2005 to October 2013. He also served as a director of SMG Corporation from 1992 through June 2007. Mr. Rabin is a consulting director of the Richard Gray Gallery, Chicago and New York, and was previously a board member of Oneida Holdings, Inc., a private corporation. Mr. Rabin attended the Wharton School of Advanced Business Management and holds an honorary Masters in Business Administration from Florida State University. We believe that Mr. Rabin'sRabin’s executive and management experience, including his experience as president of a large hotel company, well qualifyqualifies him to serve on our Board.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR"“FOR” EACH OF THE NOMINEES LISTED ABOVE. 14 SALLYBEAUTY HOLDINGS, INC. 2019 Proxy Statement

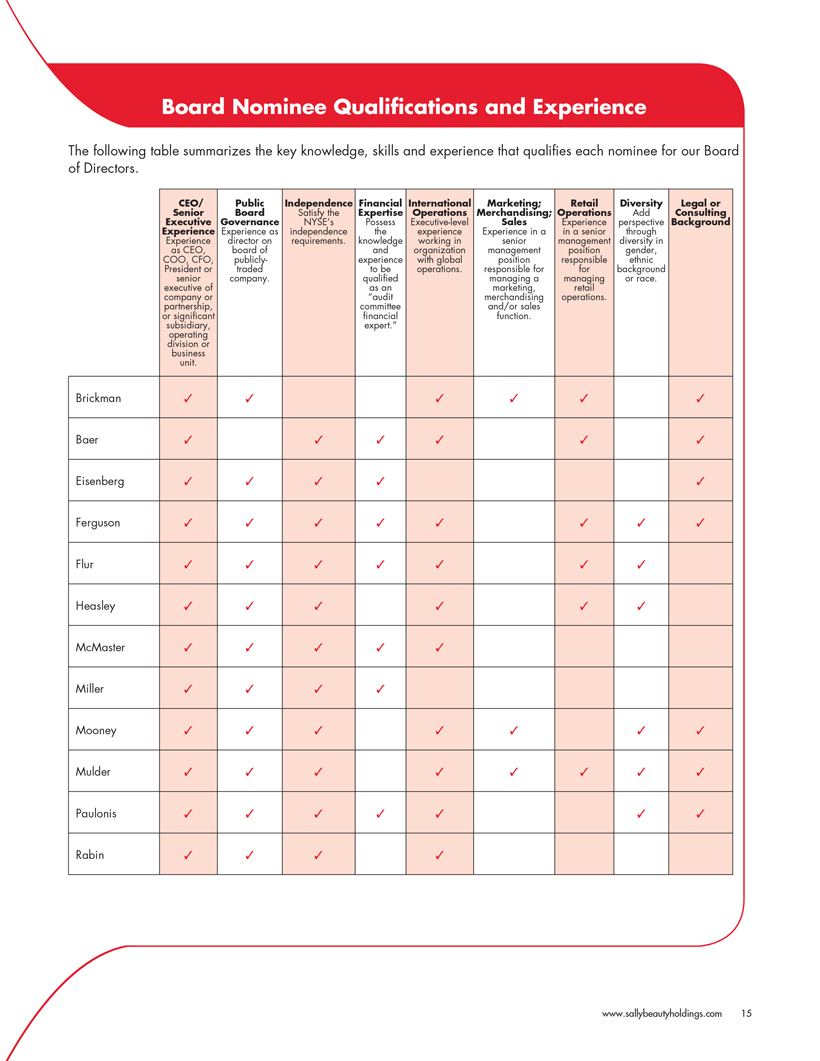

Board Nominee Qualifications and Experience The following table summarizes the key knowledge, skills and experience that qualifies each nominee for our Board of Directors. CEO/Senior Executive Experience Experience as CEO, COO, CFO, President or senior executive of company or partnership, or significant subsidiary, operating division or business unit. Public Board Governance Experience as director on board of publicly-traded company. Independence Satisfy the NYSE’s independence requirements. Financial Expertise Possess the knowledge and experience to be qualified as an “audit committee financial expert.” International Operations Executive-level experience working in organization with global operations. Marketing; Merchandising; Sales Experience in a senior management position responsible for managing a marketing, merchandising and/or sales function. Retail Operations Experience in a senior management position responsible for managing retail operations. Diversity Add perspective through diversity in gender, ethnic background or race. Legal or Consulting Background Brickman ✓ ✓ ✓ ✓ ✓ ✓ Baer ✓ ✓ ✓ ✓ ✓ ✓ Eisenberg ✓ ✓ ✓ ✓ ✓ Ferguson ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Flur ✓ ✓ ✓ ✓ ✓ ✓ ✓ Heasley ✓ ✓ ✓ ✓ ✓ ✓ McMaster ✓ ✓ ✓ ✓ ✓ Miller ✓ ✓ ✓ ✓ Mooney ✓ ✓ ✓ ✓ ✓ ✓ ✓ Mulder ✓ ✓ ✓ ✓ ✓ ✓ ✓ ✓ Paulonis ✓ ✓ ✓ ✓ ✓ ✓ ✓ Rabin ✓ ✓ ✓ ✓ www.sallybeautyholdings.com 15

INFORMATION REGARDING CORPORATE GOVERNANCE, THE BOARD AND ITS COMMITTEES

The Board oversees, counsels, and directs management in the long-term interests of the Corporation and our stockholders. The Board'sBoard’s responsibilities include:

providing strategic guidance to our management;

overseeing the conduct of our business and the assessment of our business and other enterprise risks to evaluate whether the business is being properly managed;

selecting, evaluating the performance of, and determining the compensation of the CEO and other executive officers;

planning for succession with respect to the position of CEO and monitoring management'smanagement’s succession planning for other executive officers; and

overseeing the processes for maintaining our integrity with regard to our financial statements and other public disclosures, and compliance with law and ethics.

Corporate Governance Philosophy

We are committed to conducting our business in a way that reflects best practices and high standards of legal and ethical conduct. To that end, our Board of Directors has approved and oversees a comprehensive system of corporate governance policies and programs. These documents meet or exceed the requirements established by the NYSE listing standards and by the SEC and are reviewed periodically and updated as necessary under the guidance of our Nominating, Governance and Corporate GovernanceResponsibility Committee to reflect changes in regulatory requirements and evolving oversight practices. These policies embody the principles, policies, processes and practices followed by

Because our Board executive officersis committed to corporate governance best practices, we are committed to integrating responsible sustainability and employees in governing us.corporate responsibility initiatives into our operations and strategic business objectives.

| 16 |  | 2019 Proxy Statement |

We value boardroom diversity as integral to effective corporate governance. We believe that board diversity — gender, race, age, insight, background, personality, and professional experience — is a necessity that improves the quality of strategic decision-making and long-term vision, and represents the kind of company we aspire to be.

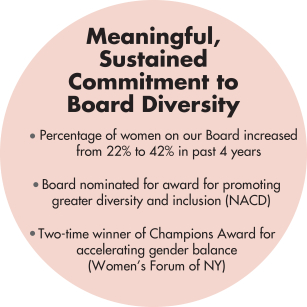

In the past four years the Board has made meaningful efforts to diversify board membership even further, increasing the percentage of women on our Board from 22 percent to 42 percent. This enhanced diversity has strengthened board-level expertise in critical areas such as: consumer goods and global retailing; corporate financial management; strategic planning and transaction execution; and integrated marketing, digital experience,e-commerce and mobile.

| Our Board’s leadership by example on diversity is being recognized. In May 2019 the National Association of Corporate Directors (NACD) named the Company’s Board as a nominee for a 2019 NACD NXT™ Recognition Award. These awards showcase breakthrough board practices that promote greater diversity and inclusion. And in November 2019 the Company became atwo-time winner of a “Corporate Champions” award, bestowed by the Women’s Forum of New York, which promotes the advancement of women on corporate boards. In 2017, the Women’s Forum honored the company as a “40% Plus Corporate Champion” for “accelerating gender balance and driving meaningful and sustainable change.” Under our Corporate Governance Guidelines, the Nominating, Governance and Corporate Responsibility Committee recommends to the Board criteria for selection of directors and reviews periodically with the Board the criteria adopted by the Board. Although the Guidelines do not contain a specific policy on diversity, the Board demonstrates — by its own diverse composition — its commitment to diversity and inclusion. |

Our Board recognizes that they play a crucial role in setting the tone for the Company’s workplace culture. The Board has encouraged leaders to hire exceptional employees with the diversity that can anticipate the needs and concerns of our customers. By hiring people with diverse voices, listening to them, and responding accordingly, we believe that we are taking the necessary steps to maintain our long-term sustainability.

| www.sallybeautyholdings.com | 17 |

Corporate Responsibility and ESG — Environmental, Social, Governance

Our Board recognizes that environmental, social, governance and sustainability (“ESG”) issues are of increasing importance to our investors, as well as our customers, and are essential to our Company’s long-term performance and value creation. Our Board is committed to corporate governance best practices and, as such, is committed to integrating responsible ESG initiatives into our operations and strategic business objectives. BOARD COMMITTEE OVERSIGHT: As an indication of our Board’s ongoing commitment to ESG issues, in January 2019, the Board adopted a revised charter for the newly-renamed “Nominating, Governance and Corporate Responsibility Committee.” With the charter change, the Board delegated to the Committee authority to oversee the Company’s corporate responsibility andESG-related matters. The revised charter is available at http://www.sallybeautyholdings.com/investor-relations/corporate-governance/governance-documents. |  |

CORE ESG VALUES REFLECTED IN OUR CODE OF CONDUCT AND ETHICS:

Our Company’s core values regarding ESG and corporate responsibility are reflected in our Code of Business Conduct and Ethics and Corporate Governance Guidelines

Our Board(the “Code”), which is the standard of Directors has adoptedconduct that applies to all of our (a) Code of Business Conduct and Ethics and (b) Corporate Governance Guidelines that apply to our directors,employees, officers and employees. Copies of these documentsdirectors. The Code reflects the Board’s beliefs about how we should conduct ourselves individually and as a company, and includes the following core values relating to corporate responsibility and ESG matters: conducting our business as a good corporate citizen in compliance with all laws, rules and regulations applicable to us and the chartersconduct of our business; conducting operations with regard to the welfare of our employees and for our Board committees arethe protection of the environment and the general public; and providing equal opportunity to all employees and job applicants.

The Code is available on our website at http://investor.sallybeautyholdings.com and areis available in print to any person, without charge, upon written request to our Vice President of Investor Relations. We intend to disclose on our website any substantive amendment to, or waiver from, a provision of the Code of Business Conduct and Ethics that applies to our principal executive officer, our principal financial officer, our principal accounting officer or persons performing similar functions. We have not incorporated by reference into this Proxy Statement the information included on or linked from our website, and you should not consider it to be part of this Proxy Statement.

Director Independence

STOCKHOLDER ENGAGEMENT:

Based on informal discussions with stockholders during the past year, the Board initiated a sustainability materiality assessment of the Company. As a result the Board determined that the Company’s ESG strategy should focus on areas where we can have a material, meaningful impact, which include Energy and Environment; Product Development and Sourcing; and Diversity and Inclusion.

Energy/Environment:We continue to make progress toward reducing our environmental impact by reducing energy usage and increasing energy efficiency. We have implemented a number of initiatives designed in part to reduce our impact on the environment.

In 2019, we rapidly consolidated our energy footprint, transitioning from two home office buildings into one, and closing four distribution centers.

In 2019, we proactively replaced 400 of our most inefficient heating/air condition units in SBS and BSG stores with units having a higher SEER energy efficiency rating.

| 18 |  | 2019 Proxy Statement |

Our new distribution center in Texas has energy saving features that should result in substantial energy reduction, such as high-flow air rotation units, motion sensor LED lights andR-19 value insulation in the roof.

We installed centralized energy management systems for lighting and heating in 64 stores and, on average, realized 34% reduction in energy per store. Based on the successful pilot, we will be implementing the energy conservation program in 200 stores, targeting those with the historically highest energy usage.

This year, we launched “SBH Going Green”, our company-wide effort to be a better corporate citizen by reducing waste and conserving energy, thereby enhancing the sustainability of our planet and the communities in which we operate. This initiative includes:

removing plastic bags from Sally Beauty, CosmoProf and Armstrong McCall stores (will eliminate ~104 million plastic bags from landfills per year);

removing Styrofoam cups and lids from SBH Corporate Headquarters (will eliminate ~280,000 pieces of Styrofoam from landfills per year); and

launching a cardboard recycling program at SBH Corporate Headquarters(~5-7 tons of cardboard per year).

Product Development and Sourcing: We continue to make progress toward our long-term sustainability goals by using best practices in product development and sourcing. All finished formulas in our owned-brand products are cruelty-free, i.e., not tested on animals. Most (90%) of our owned-brand products are vegan and we aim to have at least 95% of our owned-brand products be vegan in fiscal year 2020. Our Company strives to avoid product formulations that contain parabens and phthalates.

Diversity and Inclusion: Diversity and Inclusion are at the heart of our Company — atthe Board level, throughout ourglobal workforce, and in our shared commitment to serving adiverse customer base and their communities.

At the Board Level:Our Board’s composition shows the Company’s commitment to diversity and inclusion. Board level diversity has enhanced our Company’s board-level expertise and broadened its viewpoint. Having diverse voices on our Board sets the tone to encourage leaders at all levels of the Company to listen to the concerns of our workforce and customers alike. By listening to these voices, and responding accordingly, we are continuously evolving as a socially responsible corporate citizen and are maintaining our long-term sustainability.

Our Board’s inclusive composition and practices are being noticed and championed by others, as noted on page 17.

In Our Workforce: Our Company is 92% Female and 48% racially/ethnically diverse. In 2019 Forbes named our Company one of America’s Best Employers for Diversity.

In 2019, the Company established aDiversity and Inclusion Committee to ensure all associates feel their views, cultures and beliefs are recognized, respected and included and to provide our associates with internal advocacy and support. We recognize the value of diversity and inclusion within our teams to drive the success of the business, as our associates should — and do — reflect the various qualities of our customers and what they desire and expect from our Company.

We scored 75 out of 100 on theHuman Rights Campaign’s annual Corporate Equality Index (CEI), which measures and rates workplaces based on LGBTQ equality with respect to policies and benefits. The Company anticipates making additional adjustments during FY20 to improve our rating.

In Our Customer Base: Our customers span the entire continuum of gender and ethnic diversity. We sell products to treat and style every kind of hair; we deliver a tailored assortment of beauty products that serve the local communities where our 4,150 U.S. and Canadian stores are located. Serving the diverse demographics and needs of our customers drives a culture and workforce that embraces and reflects the communities we serve.

| www.sallybeautyholdings.com | 19 |

Our Board of Directors is currently comprised of eight tennon-management directors and Mr. Brickman, who is our President and Chief Executive Officer. Mr. Gary Winterhalter served as a Director and as our Executive Chairman until his retirement on February 2, 2016. Under the Corporate Governance Guidelines, our directors are deemed independent if the Board has made an affirmative determination that such director has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us) and such director also satisfies the other independence requirements of the NYSE. Our Board of Directors has affirmatively

determined that all of our current directors other than Messrs. Winterhalter (prior to his retirement)Mr. Brickman, and Brickman,both new nominees for directors (Mr. Baer and Ms. Flur), satisfy the independence requirements of our Corporate Governance Guidelines, as well as the NYSE, relating to directors. As part of its annual evaluation of director independence, the Board examined (among other things) whether any transactions or relationships exist currently (or existed during the past three years), between each independent director and us, our subsidiaries, affiliates, equity investors, or independent auditors and the nature of those relationships under the relevant NYSE and SEC standards. The Board also examined whether there are (or have been within the past year) any transactions or relationships between each independent director and members of the senior management of the Corporation or its affiliates.

As part of this evaluation, the Board examined Ms. Nealy Cox's former role with Stroz Friedberg, LLC, a risk management firm that provides cyber-security services to the Company, and the Company's relationship with Stroz and determined that Ms. Nealy Cox does not have a material relationship with the Company as a result of her former role with Stroz or the Company's relationship with Stroz.

All of our directors who serve as members of the Audit Committee, Compensation Committee and Nominating, Governance and Corporate GovernanceResponsibility Committee are independent as required by the NYSE corporate governance rules. In addition, all of our Audit Committee members also satisfy the separate SEC independence requirements applicable to audit committee members and all of our Compensation Committee members satisfy the additional NYSE independence requirements applicable to compensation committee members.

The Board of Directors is responsible for nominating directors for election by our stockholders and filling any vacancies on the Board of Directors that may occur. The Nominating, Governance and Corporate GovernanceResponsibility Committee is responsible for identifying individuals it believes are qualified to become members of the Board of Directors. We anticipate that theThe Nominating, Governance and Corporate GovernanceResponsibility Committee will considerconsiders recommendations for director nominees from a wide variety of sources, including other members of the Board of Directors, management, stockholders and, if deemed appropriate, from professional search firms. The Nominating, Governance and Corporate GovernanceResponsibility Committee will take into account the applicable requirements for directors under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the listing standards of the NYSE. In addition, the Nominating, Governance and Corporate GovernanceResponsibility Committee will take into consideration such other factors and criteria as it deems appropriate in evaluating a candidate, including such candidate'scandidate’s judgment, skill, integrity, and business and other experience and the perceived needs of the Board of Directors at that time. With regard to diversity, the Board of Directors and the Nominating, Governance and Corporate GovernanceResponsibility Committee believe that sound governance of the Corporation requires a wide range of viewpoints. As a result, although the Board of Directors does not have a formal policy regarding board diversity, the Board of Directors and Nominating, Governance and Corporate GovernanceResponsibility Committee believe that the Board of Directors should be comprised of a well-balanced group of individuals with diverse backgrounds, educations, experiences and skills that contribute to board diversity, and the Nominating, Governance and Corporate GovernanceResponsibility Committee considers such factors when reviewing potential director nominees.

Stockholder Recommendations or Nominations for Director Candidates

Our Corporate Governance Guidelines provide that our Nominating, Governance and Corporate GovernanceResponsibility Committee will accept for consideration submissions from stockholders of recommendations for the nomination of directors. Acceptance of a recommendation for consideration does not imply that the Nominating, Governance and Corporate GovernanceResponsibility Committee will nominate the recommended candidate. Director nominations by a stockholder or group of stockholders for consideration by our stockholders

at our annual meeting of stockholders, or at a special meeting of our stockholders that includes on its agenda the election of one or more directors, may only be made pursuant to Section 1.06 or Section 1.07, as applicable, of ourBy-Laws or as otherwise provided by law. Nominations pursuant to ourBy-Laws are made by delivering to our Corporate Secretary, within the time frame

| 20 |  | 2019 Proxy Statement |

described in ourBy-Laws, all of the materials and information that ourBy-Laws require for director nominations by stockholders. All notices of intent to make a nomination for election as a director shall be accompanied by the written consent of each nominee to serve as a director.